PORTLAND, Ore. — For more than a century, Oregon has honored its disabled veterans by offering a break on property taxes. The law is intended to help reduce the cost of home ownership for those injured while serving our country.

Critics argue this tax exemption hasn’t kept up with rising real estate prices — leaving some veterans struggling to stay in their homes.

“It would just be a shame if I would have to move because of a tax,” explained Shannon Normington of Northeast Portland.

The U.S. Army veteran was injured while deployed in Iraq. He is reliant on VA disability benefits for income — a good chunk of which goes toward his nearly $9,000 a year property tax bill.

“I have no way to increase my earnings and I have no way to challenge the tax, so I’m just stuck kind of trying to tread water,” said Normington.

The 46-year-old purchased his Northeast Portland home in 2010. Normington admits, he could sell his home and move to a lower tax neighborhood— but he’d prefer to stay.

He grew up in the neighborhood. He coaches youth football and his teenage son attends school nearby.

“There’s got to be a way to figure this out,” he added.

The partial exemption of assessed value for property for disabled veterans has been part of Oregon law since 1921, according to the Oregon Department of Revenue. The original statute describes benefits available to veterans of “the Mexican War, the Civil War, the Indian Wars, the Spanish-American War” and other distant conflicts.

Over the years, the law has been modified a few times. In 2005, the Oregon legislature added a three percent annual increase to the disabled veterans’ property tax exemption. Critics argue the law hasn’t kept up with soaring property values. In short, the property tax break for disabled veterans in Oregon has become less and less.

“When the property values escalated in the 70’s and 80’s, there was no mechanism to keep the exemption in check with those property value increases,” explained Steve Bates, chair of the Vietnam Veterans of America Committee on Memorials and Remembrance. “These guys aren’t being treated the way we used to treat veterans.”

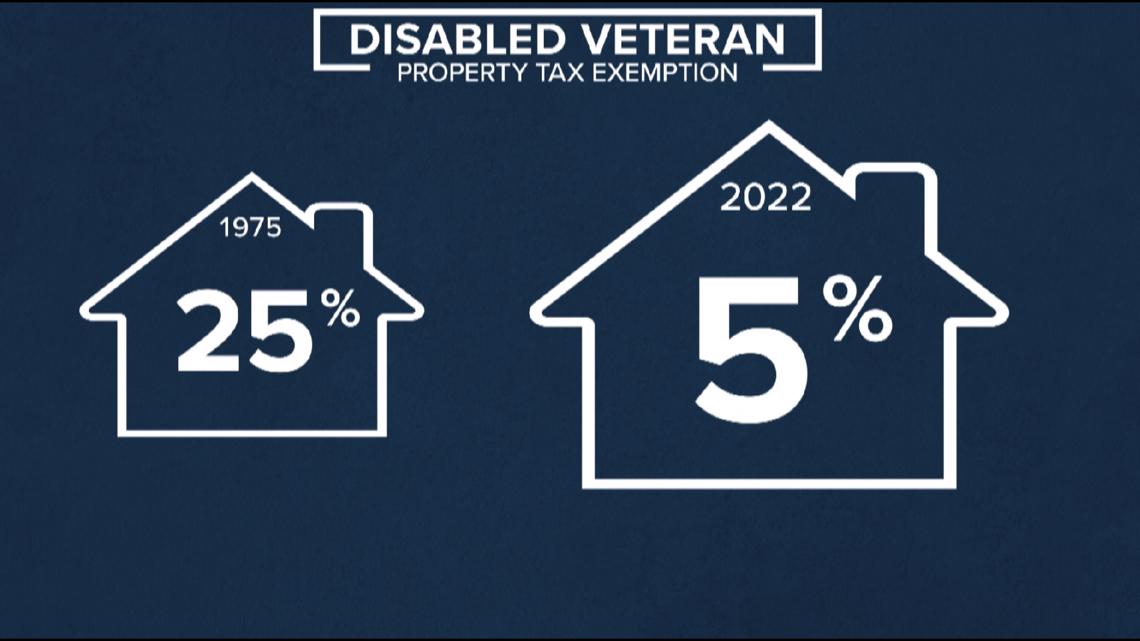

For example, in 1975, the property tax exemption for disabled veterans in Oregon was $7,500. At that time, the average home value in Portland was $30,500 — which meant disabled veterans got a roughly 25% deduction in property taxes.

Today, the current deduction for disabled veterans in Oregon is $28,886 — which means for the average Portland home selling at $550,000, the property tax deduction for disabled veterans is now only 5 percent.

“We need to honor them for their sacrifice,” said Bates, who testified in support of Senate Bill 500 in 2019. The bill, which would have reduced veterans’ property taxes, passed unanimously out of the Senate but died in the House. Over the years, there have been various other failed attempts in Salem to help disabled veterans and their families with the cost of housing.

Opponents of a similar proposal in 2022 argued a loss in property tax revenue could negatively impact local budgets and school funding.

More than 15 other states have increased their property tax exemptions for disabled veterans, according to 2019 testimony before the House Committee on Revenue.

Normington argues it is more important now than ever to keep our veterans in their homes.

“There’s a fair number of people who fought for this country who are out there on the streets,” said Normington, who hopes the Oregon state legislature will tackle the issue during its next session.