PORTLAND, Ore. — U.S. Senator from Oregon Ron Wyden is crisscrossing the state in what he calls a "full-court press" for enhanced child tax credits.

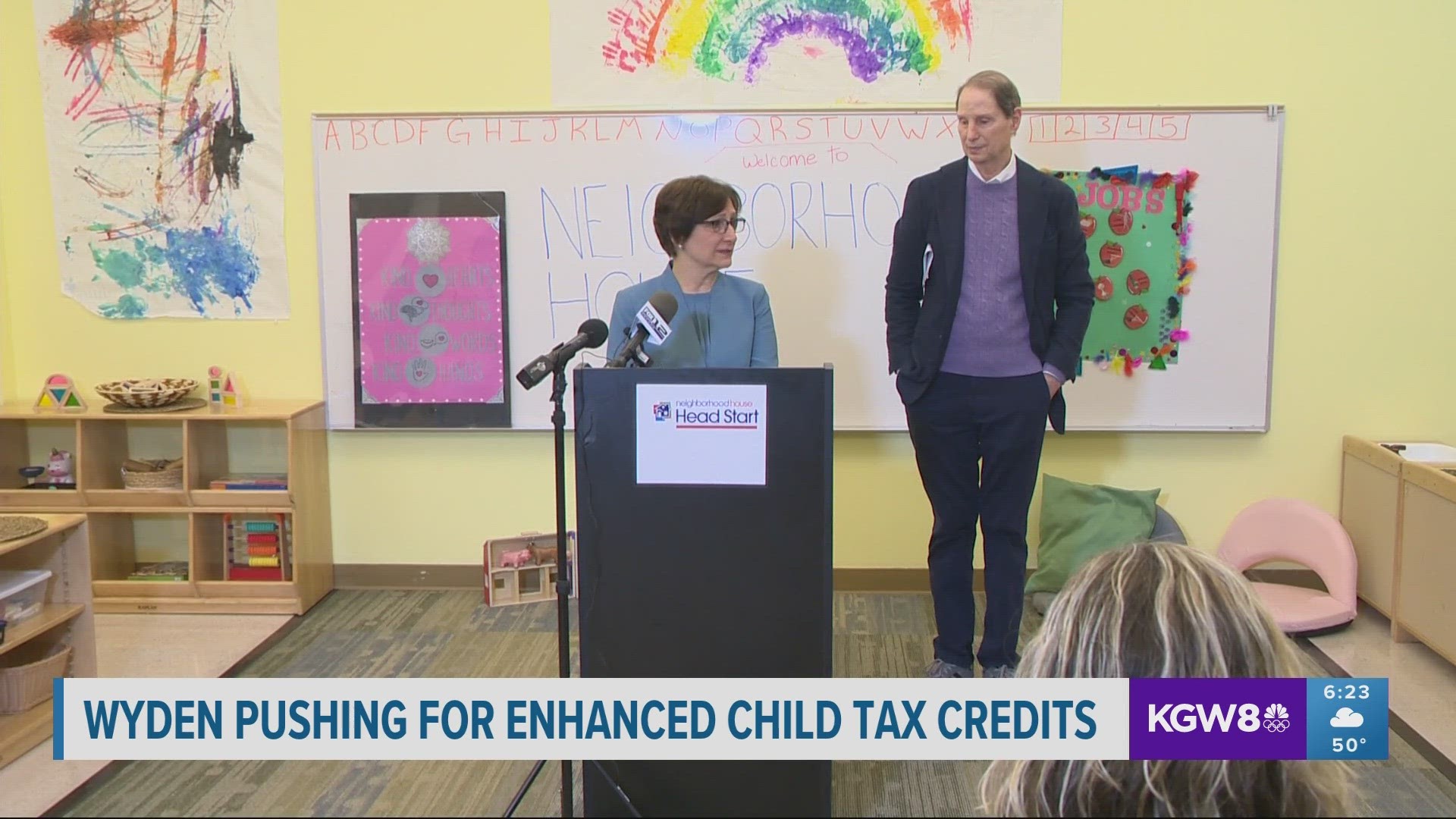

On Thursday, Wyden joined Congresswoman Suzanne Bonamicci at the Neighborhood House Children's Center at Ramona, home to a Head Start program.

Wyden is co-sponsor of the Tax Relief for American Families and Workers Act. Among other things, it would increase the child tax credit from its current cap of $1,400 to $1,800 for the 2023 tax year, $1,900 in 2024 and $2,000 in 2025, and would begin adjusting for inflation. It would also let parents claim the credit for each child in the family.

"It seems to us that what the Oregon way is all about is giving everyone in Oregon, in our country, a chance to get ahead," Wyden said, "and that's why this child tax credit is so important."

The bill has passed the U.S. House of Representatives, but Wyden said it may have more trouble in the Senate. He hopes to get it passed before the tax deadline of April 15 — but if it were to pass after that, it would be retroactive for this year's tax filers.

"We want to get it now while the country is thinking about what taxes are all about," Wyden said. "And taxes are about giving everybody in America the chance to get ahead."

When Congress passed the American Rescue Plan in March 2021, it included a much more generous child tax credit: $3,600 for children ages 5 and under and $3,000 for kids 6 through 17. The credit brought child poverty to a historic low of 5.2%. But Congress did not renew the enhanced credits for 2022, and poverty rates more than doubled.

"Because it works and it works so well, we must bring it back," Bonamici said. "Working families still need that support — as you heard, childhood poverty shot right back up when the enhanced child tax credit expired."